Cookieless tracking: How marketers can navigate a privacy-first web

![]() Learn about cookieless tracking, the benefits, and how marketers can leverage first-party data to deliver highly personalized experiences.

Learn about cookieless tracking, the benefits, and how marketers can leverage first-party data to deliver highly personalized experiences.

Anyone old enough to have enjoyed PBS’s popular home improvement show “This Old House” remembers legendary master carpenter Norm Abram’s famous saying: “measure twice, cut once.” In the world of carpentry, angles matter, and there’s no escaping the evidence of two poorly joined pieces of wood.

We live in the opposite world — one in which we cut first and endlessly measure the different ways in which we did it. This is because in experience delivery, there’s no single yardstick for data for measurement, and the goals seem to keep changing in real time.

When third-party cookies were still abundant, we could rally around measurement criteria — a multitouch attribution model — that, while not perfect, could create a baseline to follow.

You could assign various weights to different types of engagements (viewing an banner ad worth X, clicking it worth more, and buying something even more).

Some companies were famous for grading their own homework, making last-touch attribution (inevitably a search click) the most powerful model.

Fast forward to today, and we still see a lot of old thinking around measurement, especially in digital channels – despite the primary source of data (the 3rd party cookie) becoming extremely limited in scale and scope.

Last year I speculated on whether CDPs could help solve the MTA problem, writing:

“The combination of more user-level insights on touchpoints like the call center, e-commerce, and sales interactions — combined with addressable marketing data — will change the way analysts value ‘touches.’ The realtime availability of such data, tied to a persistent person ID, will unleash AI with the ability to fine-tune models with precision.”

While I still agree with those sentiments, there’s a long way to go in terms of enterprises’ ability to capture, unify, and ultimately weigh the interactions that can effectively measure success.

![]() Learn about cookieless tracking, the benefits, and how marketers can leverage first-party data to deliver highly personalized experiences.

Learn about cookieless tracking, the benefits, and how marketers can leverage first-party data to deliver highly personalized experiences.

In a world where the marketing inputs constantly change (different campaigns, creatives, vendors, calls-to-action, etc.) how can you construct a reliable measurement model to handle such complexity?

Maybe it’s time to opt for simplicity.

The latest G2 peer-review report ranks SAP Commerce Cloud, SAP Sales Cloud, and SAP Service Cloud as leaders in multiple categories.

The latest G2 peer-review report ranks SAP Commerce Cloud, SAP Sales Cloud, and SAP Service Cloud as leaders in multiple categories.

The wonderful ability to upload a few hundred thousand hashed e-mails to a vendor’s device graph and lookalike model a few thousand prospects has gone the way of the DMP. So has most second-party data-sharing, as it was based on cookie identity with vague privacy compliance.

Today, data cleanrooms look like a promising way to query data across entities without data moving, but it’s still a challenge to achieve precision by merging two relatively small pools of quality first-party data.

As we move from a top-down identity approach (companies buy identity services and data from a vendor) to a bottoms-up footing (customers offer their data to companies in exchange for value), it’d be nice if we could measure what it takes to grow a first-party data asset. What if there were a new metric, we could use such as “cost per data authentication?”

The ultimate sign that a customer trusts a brand with their data is the act of signing up and creating an account, whether that happens within a store’s point-of-sale system, a mobile app, call center agent, or a website.

This is also where customers:

This has significant value, as any large publisher who sells their advertising, or any start-up valued on “monthly active users” can attest.

While the actual monetary value of authentication will vary depending on the company and product(s) under consideration, I think we can agree on the premise: this is the unicorn of data that we’ve been talking about for so long — real customers who are engaged with a brand.

Passwordless authentication is gaining traction as brands grapple with the risks posed by traditional account passwords. Learn how it works and the business benefits.

Passwordless authentication is gaining traction as brands grapple with the risks posed by traditional account passwords. Learn how it works and the business benefits.

So, we’ve discovered where the unicorn of data lives. What’s next?

My point here is not that this approach is novel but, rather, that having your brand own the measurement criteria and methodology is better than solely depending on the platform’s reporting to determine success.

Top brands are using customer data to understand the customer journey and deliver positive experiences that boost loyalty and revenue.

Top brands are using customer data to understand the customer journey and deliver positive experiences that boost loyalty and revenue.

A customer data platform, or CDP, gives brands several different options for creating a yardstick to measure the value of data authentication and progressive preference acceptance.

Let’s look at the value of actual authenticated (registered) commerce buyers versus those who have purchased as guest users. This is easy to set up in a CDP and monitor.

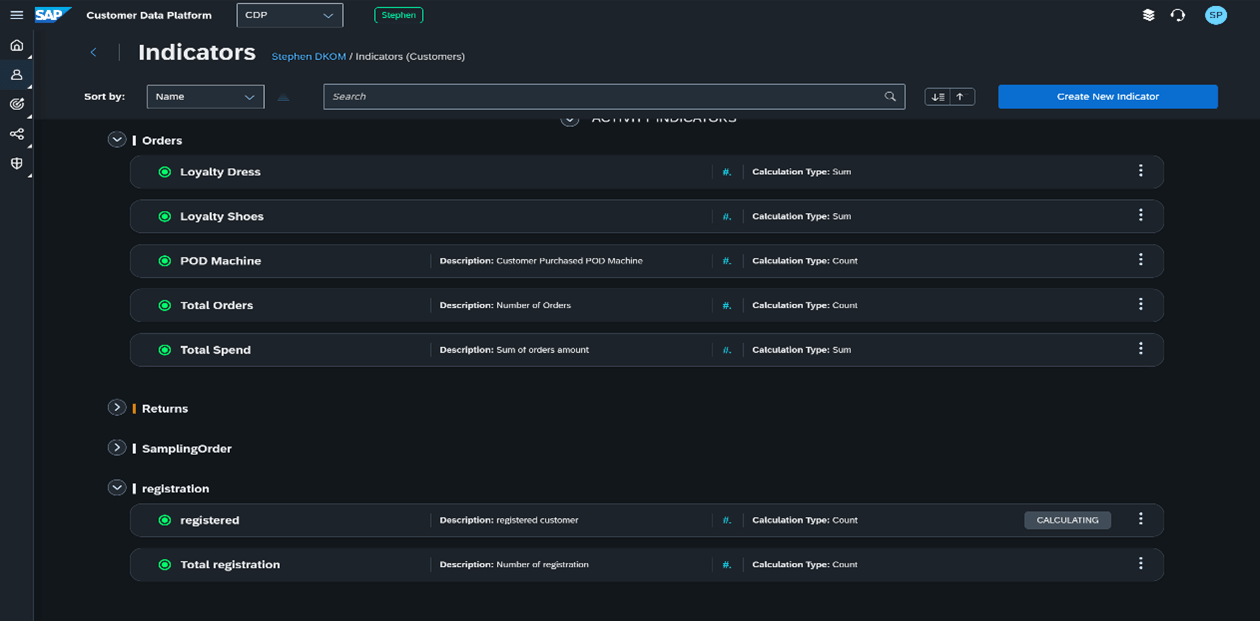

First, you’d set up various activity indicators to track events of interest:

Then, you’d set up an activity indicator to track when customers register — this can be expanded to count registrations by specific sources so you can see where to invest (search engine marketing or Facebook Ads, for example). Next, set up an activity indicator to track orders (this can be a generic indicator for both registered and guest customers):

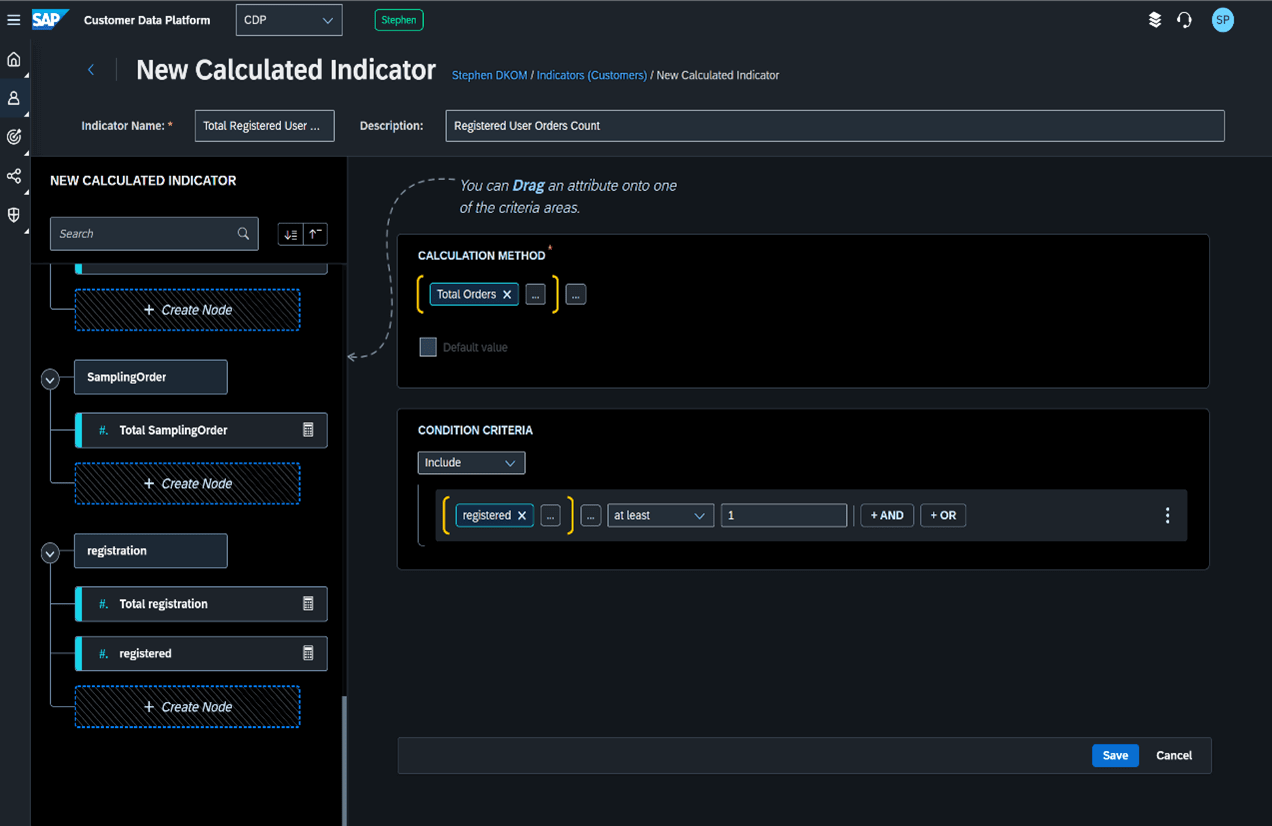

Now it’s time to create a calculated indicator, which is required to monitor across the activities and calculate how many orders have been placed by each registered user. This would allow you to see what the average order count for registered versus guest users — the metric we’re interested in.

If 100 customers register and place an average of ten orders a year, versus two orders per year for guests, then you can easily determine the lifetime value uptick in registered users.

Now, you can easily understand the propensity value of registration, and assign a specific “value per authentication,” which can also be calculated in reverse as “cost per authentication” given your average customer acquisition costs.

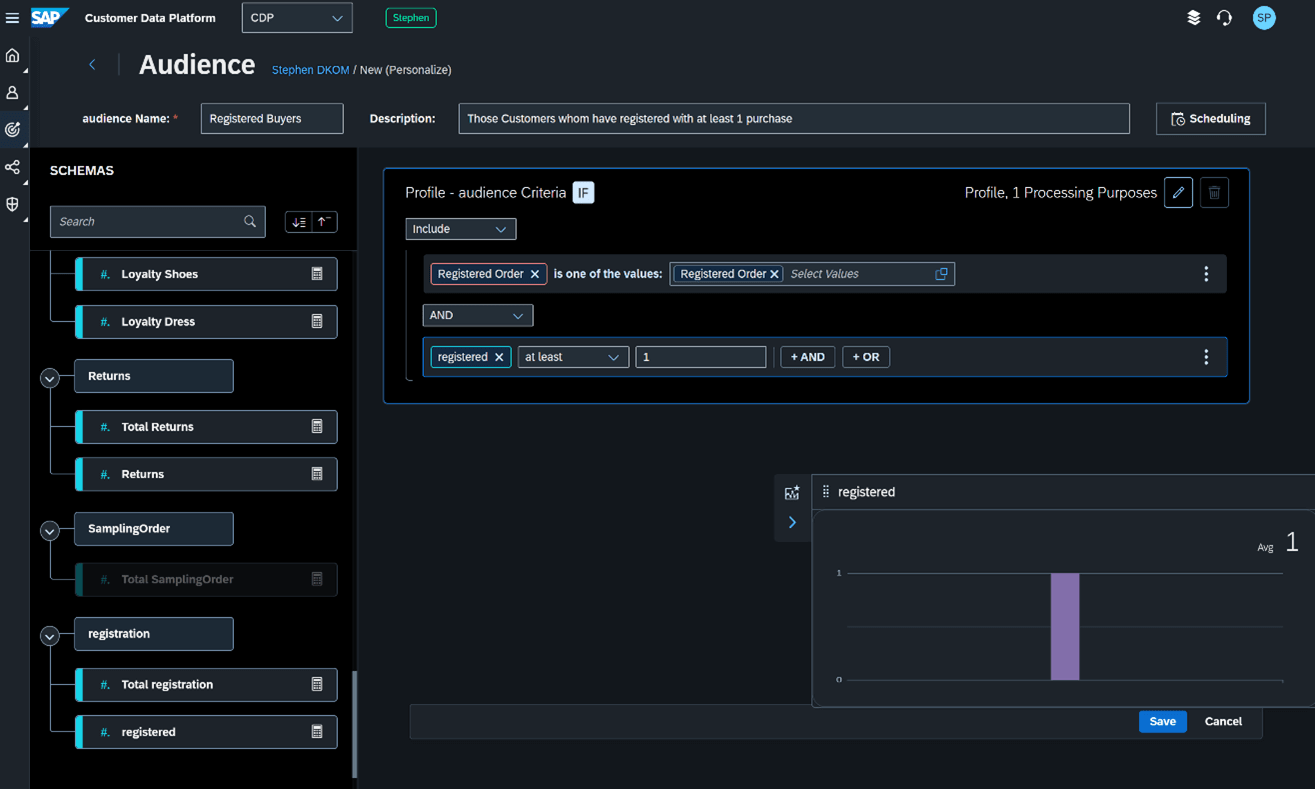

You can then create many more segments and different tiers in your segments to track how many customers are registered and have at least one order, then at least five orders, then 10, etc:

Now you have a framework to understand the cost to acquire an authenticated user and model their lifetime value, as compared to guest users.

I’m not suggesting that better marketers aren’t using many of these tactics today — they are. That said, I believe companies are more focused on understanding “cost per acquisition” or “cost per click” and many other metrics, and not starting with the simpler measurement of the authentication, without which there can be no real customer relationship.

Setting a “cost per authentication” benchmark can help guide enterprises that want to value a vendor’s ability to generate new customers — and highlight the importance of putting more concrete value behind the importance of establishing an authenticated, privacy-first, relationship with them.

By starting with a better understanding of the actual cost and value of data-authenticated users, your brand will be in better position to create benchmarks for measuring almost any addressable touchpoint across CX.